Arizona NATIVE AMERICAN Home lender

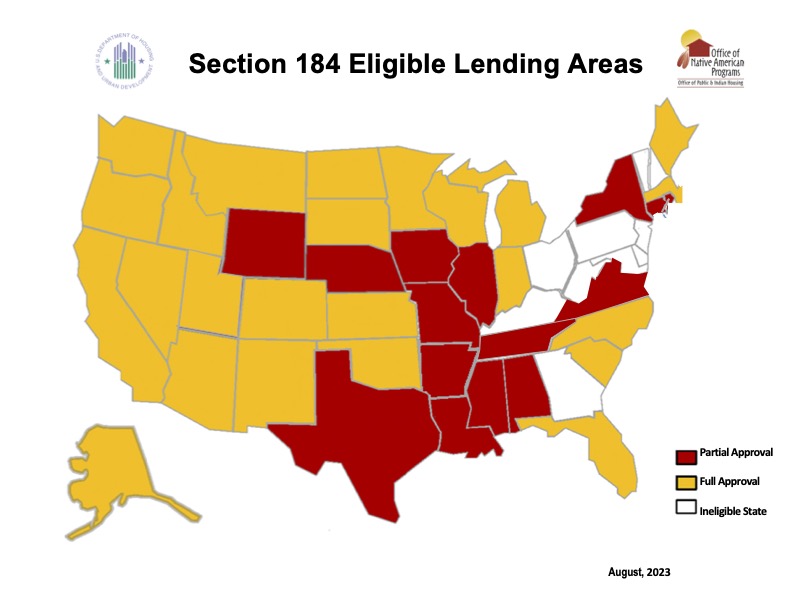

Are you a Arizona Native American? Capital Home Mortgage Arizona is a Arizona Native American Home Lender dedicated to helping Tennessee residents with Arizona Native American Home Loans. The Arizona HUD-184 Loan is a federally-backed loan program by the Department of Housing and Urban Development offering low Arizona Native American Mortgage Rates. It was created specifically to provide Native American tribal members access to mortgage financing with flexible terms. The Arizona Section 184 Loan Program is open to any one member of a federally recognized tribe. The Loan is available to all Arizona Native Americans, first-time and repeat homebuyers, as long as they have a Tribal Membership or Citizen Card from a tribe officially recognized by the government. If you are a member of a Arizona Native Tribe and believe you may be eligible for an Arizona HUD 184 Home Loan, our dedicated Arizona HUD 184 Loan officers can help! We provide free consultations, answer any questions you may have about a Section 184 mortgage, and will walk you through all available loan options.

Capital Home Mortgage Arizona is a full-service Arizona Native American Mortgage Lender that offers and specializes in Arizona Native American Home Loans in Arizona . We have helped countless Arizona Native Americans achieve their homeownership, and we can do the same for you too! Call today (480) 360-6650 to speak with one of our Arizona HUD-184 Home Loan Specialist.

Arizona Native American Home Loans

Qualifying for an Arizona HUD 184 Loan

Are You Interested in an Arizona HUD-184 Loan? Here are some important details you need to know before applying for the Native American Home Loans.

- Credit Score: The HUD-184 Loan does not require a minimum credit score, making it ideal for qualified but credit-challenged borrowers.

- Debt-to-Income Ratio: A single back ratio of 41% debt-to-income ratio to determine the loan size borrowers can afford.

- Borrower Income Limit: The HUD-184 Loan does not apply to borrower income limits.

- Down Payment : The HUD-184 Loan has some of the lowest down payment requirements in the market.

- Closing Costs: This money could come from your savings, investments, or gifts from family members. Tribal assistance is also accepted.

- First-Time and Repeat Buyers: Compared to other low-down-payment mortgage programs, this one is open to first-time and repeat home buyers.

- Eligible borrowers may participate in the program multiple times but are allowed only one Section 184 Loan at a time

Arizona Native American Purchase Loan

Arizona HUD 184 Home Loans are solely for Native Americans and offer a variety of purchase benefits.

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Arizona Native American REfinance Loan

Arizona HUD 184 Refinance Home Loans can streamline rate & term, equity cash-out, or Rehabilitation of current residence.

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Arizona Native Americans Overview

Arizona is home to numerous Native American tribes, each with its own unique culture, history, and traditions. Some of the prominent Native American tribes in Arizona include:

Navajo Nation: The Navajo Nation is the largest federally recognized tribe in the United States. They are known for their rich culture, including their language, art, and traditional ceremonies. The Navajo reservation covers parts of Arizona, New Mexico, and Utah.

Hopi Tribe: The Hopi Tribe is known for their distinct culture, especially their religious ceremonies and traditional pottery. The Hopi reservation is located in northeastern Arizona, primarily in Navajo and Coconino counties.

Apache Tribes: There are several Apache tribes in Arizona, including the White Mountain Apache, San Carlos Apache, and Fort Apache Indian Reservation. The Apache people have a rich cultural heritage and are known for their skilled craftsmanship, including basket weaving and beadwork.

Tohono O’odham Nation: The Tohono O’odham Nation resides in southern Arizona and northern Mexico. They have a deep connection to the land and are known for their basket weaving and traditional agricultural practices.

Pueblo Tribes: While most Pueblo tribes are located in New Mexico, some also have communities in Arizona, such as the Zuni Pueblo and the Acoma Pueblo. These tribes have rich cultural traditions, including pottery, dance, and religious ceremonies.

Yavapai-Apache Nation: The Yavapai-Apache Nation is located in central Arizona and consists of members from both the Yavapai and Apache tribes. They have a unique history and cultural heritage that reflects both of these tribal influences.

These are just a few examples of the Native American tribes in Arizona, and there are many more with their own distinct identities and histories.

Why Arizona HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

Arizona Native American Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for Mortgage Securities

- Property Securing the Mortgage

- Occupancy of the Property

- Loan to Value of the Property

- Borrower’s Credit Worthiness

Arizona Native American Mortgage Team

Arizona Mortgage Company Reviews

Arizona Mortgage Programs

Arizona Home Purchase loans

Looking to Purchase an Arizona Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Arizona Renovation Home Loans

Looking to Rehab an Arizona Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Arizona FHA Home loans

Great 1st Time Arizona Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Arizona va Home Loans

100% Financing for Arizona Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Arizona Conventional Home loans

Flexibility for Arizona Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

Arizona Jumbo Home Loans

Arizona Non-Confirming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Arizona USDA Home loans

100% Rural Arizona Home Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Arizona Native american Home Loans

Arizona Hud 184 Home Loans

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Arizona Manufactured Home loans

Great Alternative Arizona Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Arizona Reverse Mortgage Loans

Your Arizona Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Arizona Non QM Home loans

Making Arizona Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Arizona One Time Close Home Loans

Build Your Arizona Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Arizona Refinance Mortgage loans

Arizona Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Arizona Cashout Mortgage Loans

Arizona Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education