Abilene Native American Mortgage Lender

Abilene Native American Home Loans

Homeownership among Native Americans has been a historically underserved market, partly because of the unique nature of Indian lands in Trust. However, thanks to the Section 184 Program, lenders can now finance home purchases on native lands, making homeownership more accessible for Native Americans and Alaskan Natives.

Capital Home Mortgage is a full-service mortgage company offering competitively-priced Native American Home Loans in Abilene, TX. As a direct mortgage lender, we have complete authority over the whole lending process. Our simplified workflow and extensive experience in HUD-184 loans allow us to provide our clients with a pleasant and stress-free homebuying experience.

The Section 184 Loan Program

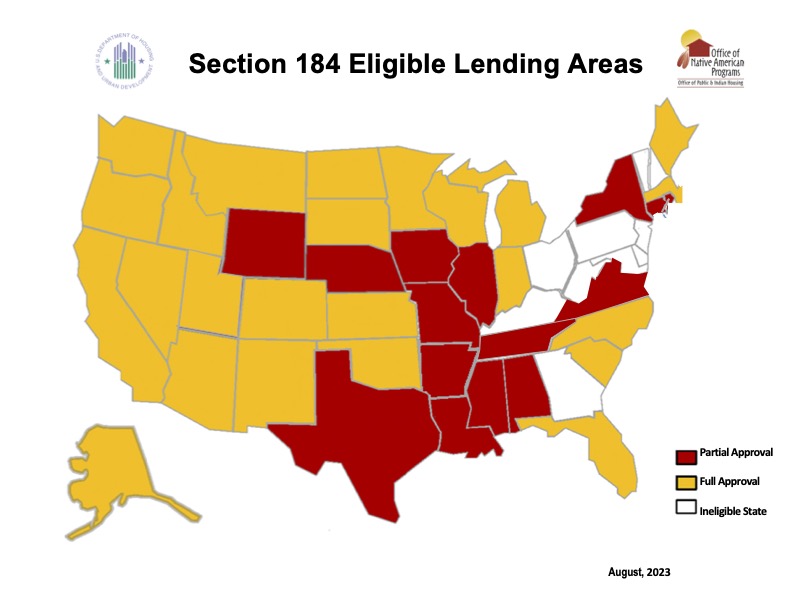

Mortgages under Section 184 can be used to buy property within and outside Native American reservations. These mortgages were created to give Native Americans and Alaska Natives a more affordable way to purchase a home on tribal land. Many members of tribal communities would be denied the opportunity to build wealth through homeownership if not for this program.

HUD-184 Loan Eligibility

Native Americans who are members of federally recognized tribes can apply for loans through the Section 184 Loan Program, given that they can provide proof of tribe membership or citizenship.

One of the significant benefits of this loan program is that only one of the applicants needs to be a tribal member. You can still qualify for the HUD-184 loan program even if your non-tribal-member spouse is your household’s sole provider/income earner.

What You Need to Know About Section 184 Loans

If you meet the eligibility requirements and are interested in obtaining a Section 184 loan, here are some essential things to know/consider before actually applying for the mortgage:

1. Credit Score Requirements

There is no required minimum credit score for a HUD-184 loan, making it accessible to borrowers who may otherwise be denied due to poor credit or lack of credit history. Moreover, borrowers with less-than-perfect credit histories are not penalized with higher interest rates like most mortgage programs.

2. Debt-to-Income Ratio

For the most part, lenders look at borrowers’ debt-to-income ratio, typically set at 41%, to determine how much money they can afford.

3. Borrower Income Limit

There are no income requirements for the HUD-184 Loan as long as the borrower can prove their ability to make payments.

4. Down Payment and Closing Costs

The down payment requirements for a HUD-184 loan are among the industry’s lowest. The minimum down payment for loans over $50,000 is 2.25%, while the minimum down payment for loans under $50,000 is 1.25%. And while the government requires a one-time guarantee fee of 1.5%, the money can come from various sources, including investments, savings, or gifts from loved ones. Tribal assistance is also accepted.

5. For Both First-time and Repeat Buyers

Unlike other low-down-payment mortgage programs, this one is available to first-time and repeat buyers. Qualified borrowers who qualify may participate in the program multiple times but can only have one Section 184 Loan at a time.

6. Buy, Build, Renovate, Refinance

The HUD-184 Loan can be used for the purchase, construction, or improvement of a primary residence by eligible borrowers. The favorable terms of HUD-184 loans are a significant draw for many homeowners who want to refinance their current mortgages.

7. Manual Underwriting

HUD-184 loans are manually reviewed in great detail, as opposed to being submitted to a computer that would then approve or disapprove the Loan based solely on numbers. Any luck will increase your chances of getting a mortgage that works for you.

Is It a Good Option for Native American Homebuyers?

A HUD-184 loan is the best option for Native American homebuyers because of its favorable terms and flexibility. The thing is, a Section 184 loan can be hard to secure.

If you are a member of a federally recognized Native American tribe, the loan specialists at Capital Home Mortgage can help you obtain a Section 184 loan. Whether you’re interested in a Section 184 mortgage or some other type of Loan, we’re here to help. Call our Native American Team today at (800) 536-8171!

Why Texas HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Mortgage Payment

Abilene Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Abilene Native American Purchase Loans

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Abilene Native American REfinance Loans

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Texas Mortgage Programs

Texas Home Purchase

Thinking of Buying a Texas Home?

Looking to Purchase a Home? We have the loan program for you… Call today to speak with a loan officer to discuss your personal mortgage options.

- Primary, Secondary, Investment

- FHA, VA, USDA, Native American

- Conventional, Jumbo, Non QM

- Reverse, Renovation, Manufactured

Texas renovation home loans

Looking to Rehab a Texas Home?

Want the Charm of an Older Neighborhood? But want a new place or a fresh look? Why not look at a renovation loan? Purchase the Perfect Home and make it your own. Call today.

- Remodel, Renovate or Repairs

- FHA 203K Streamline or full

- fannie mae homestyle reno

- freddie mac home choice reno

Texas FHA Home Loans

Great for 1st Time Texas Homebuyers

FHA Home Loans are great for first time home buyers, buyers with less than perfect credit, or buyers needing less out of pocket. Call today to get started.

- Smaller Down Payment

- Flexible Underwriting

- Higher Debt to Income Ratios

- Lower Credit Scores OK

Texas VA Home Loans

100% Financing for Texas Veterans

Proudly Serving Active Duty servicemen and women, as well as, retired and disabled veterans. Call today to speak with a VA loan officer.

- Simply Qualifying for Veterans

- No Down Payments Requirements

- Lower Credit Scores Accepted

- Manual Underwriting Allowed

Texas Conventional Home Loans

Flexibility for Texas Homebuyers

Conventional Home Loans are the best option for flexibility of property types and for mortgage loan terms. Call today to get speak to a Loan Officer.

- Primary, 2nd Home, Investment

- Great Rates & Low Fees

- Single Family and Multi-Family

- Renovation Loan Programs

Texas Jumbo Home Loans

Texas Non Conforming Loans

Jumbo Home Loans also called Non Conforming Home Loans are great options for buyers needing financing outside of agency limits. Call today to speak to a loan officer.

- Primary Residence and 2nd Homes

- Higher Loan Amounts – 3 Million

- Great Interest Rates

- Investor Specific Guidelines

Texas USDA Home Loans

100% Rural Texas Home Loans

USDA Loans are a great option for families wanting to live outside of the city. Call today to speak with a loan officer to discuss your personal loan options.

- Rural Properties Only

- Primary Residence Only

- Geographic Restrictions

- Income REstrictions

Texas Native American Home Loans

Texas HUD 184 Home Loans

HUD 184 Home Loans are solely for Native American and offer a variety of benefits. Call today to speak with a loan officer to find out more.

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

Texas reverse mortgages

Your Texas Home at Work

Reverse Mortgage Loans offer seniors options to use their home’s equity for cash or to eliminate payments. Call today to get speak to a Reverse Loan Officer.

- primary residence only

- simple qualifying – equity based

- credit scores not applicable

- Minimum age 62

Texas Non QM Home Loans

Making Texas Mortgages Possible

Looking for Non Traditional Home Mortgage Loan? Contact a Loan Officer Today to discuss the alternative mortgage options currently available.

- Purchase, Rate and Term & Cash-out

- Primary, Secondary and Investment

- Full Doc & Bank Statements Programs

- Corporations OK

Texas One Time Close mortgages

Build Your Texas Dream Home

Want to Build? But unsure of what the future looks like? Remove the risk with a One Time Close Construction Loan. Call today to see how a OTC loan works.

- Primary Residence Only

- Close Once

- Lock Rate at Contract

- Traditional Final Mortgage

Texas Refinance Mortgage Loans

Texas Rate & Term Refinance

Refinancing can be a hard decision and the payback can sometimes be confusing. Call today and let our Loan Officers walk you through the process.

- Reduce Mortgage Term

- Lower Monthly Payments

- Appraisal Waivers

- Streamline Options Available

Texas Cash-out Home mortgages

Texas Equity Mortgage Loans

Cash-Out Mortgage Loans make use of the equity in your home by allowing you to refinance the current mortgage and access this equity to use as you see fit.

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Vacation or Education