Capital Home Mortgage Ohio

Ohio Home Loans

Ohio Mortgage Lender

Home Loans in Ohio

Welcome to Capital Home Mortgage Ohio, where we strive to provide Ohio Home Loans to Ohio homebuyers and homeowners at competitive rates and fees while giving great service. First and foremost, we’d like to thank you for the opportunity to earn your business. We recognize that acquiring a house is the most important decision of most people’s life, which is why Capital Home Mortgage Ohio offers dedicated points of contact throughout the mortgage process. This assures a stress-free experience, with an on-time close. After all, buying a home should be enjoyable.

Capital Home Mortgage Ohio, as a direct Ohio Mortgage Lender, manages the entire lending process from beginning to end. Our in-house processing and underwriting enables for quick, sensible approvals and timely closings. We have complete control over every detail from the application to funding.

Capital Home Mortgage Ohio is a full-service Ohio Mortgage Lender that offers a wide range of mortgage products as well as competitive Ohio Mortgage Rates. Whether you are a first-time purchaser seeking an Ohio FHA Home Loan, looking for a rural property and needing an Ohio USDA Home Loan, an active or retired veteran in need of an Ohio VA Home Loan, or a seasoned buyer in need of an Ohio Conventional Home Loan, we are here to assist.

Call today (216) 274-1004 to talk to one of our Ohio Loan Officers.

Ohio, referred to as the “Buckeye State” due to the abundance buckeye trees, is situated in the Great Lakes region of the United States. Ohio is a state bordered to the north by Lake Erie, Pennsylvania to the east, West Virginia to the southeast, Indiana to the west, and Kentucky to the south. Ohio’s largest city, Columbus, also serves as the state capital. Columbus is an important hub for trade, culture, and education.

Ohio is home to other significant cities, besides Columbus, including Cleveland, Cincinnati, Toledo, Akron, and Dayton. These cities are important centers of the state’s economy and culture. Manufacturing, finance, healthcare, and education are some of the main industries of Ohio’s diverse economy. Ohio, which has long been recognized for its strength in manufacturing, has gradually expanded its economy.

Numerous notable institutions and colleges, such as Miami University, The Ohio State University, Case Western Reserve University, and University of Cincinnati, are located in Ohio.

Ohio has a robust industrial foundation, especially in the steel, equipment, automotive, and aerospace industries. With a wide variety of museums, theaters, and performing arts venues, Ohio boasts a rich cultural legacy.

The state is also well-known for its professional sports teams, which include the NFL’s Cleveland Browns, MLB’s Cincinnati Reds, NFL’s Cincinnati Bengals, and NBA’s Cleveland Cavaliers. Additionally, Ohio is a popular destination for outdoor pursuits including boating, hiking, and camping due to its abundance of parks, lakes, and recreational places.

Ohio was a major player in American history, especially in the Civil War, the Northwest Indian Wars, and the Industrial Revolution. It served as a crucial battleground state in multiple presidential elections as well.

All things considered, Ohio offers both locals and tourists a wealth of cultural and recreational options, as well as a varied economy and rich historical background.

Ohio’s real estate market has a range of homes to suit different tastes and price ranges, including urban, suburban, and rural areas. In Ohio, the cost of a median home varies based on where you live, with metropolitan regions typically costing more than rural ones. Ohio is a desirable option for purchasers looking for affordability because, according to recent data, its median home price is around the same as the national average.

The Ohio housing market has been growing steadily on average, with some volatility brought on by variables like interest rates, employment rates, and general economic conditions. Urban areas have seen a rise in housing demand recently, especially in Cincinnati, Cleveland, and Columbus, which has raised prices and intensified competition for available houses.

In Ohio’s real estate market, inventory levels differ depending on the area and state of the market. There might not be as many houses available in some neighborhoods, which would make purchasing more competitive and possibly raise prices. In contrast, there might be more inventory than demand in some places, especially rural ones.

Ohio has a strong rental market, offering a variety of properties for rent, including apartments, single-family homes, and condominiums. The location, size, and amenities of a property are just a few of the variables that affect rental prices. Rental costs are typically greater in urban regions than in rural ones. Strong rental markets can be found in places like Cincinnati, Cleveland, and Columbus because of their expanding workforces and job prospects.

Ohio has chances for real estate investors, especially in locations that are going through economic rehabilitation and growth. Properties are available for both short-term investment methods like flipping or vacation rentals, as well as long-term rental income.

Ohio’s real estate market’s future prospects are dependent on a number of variables, including interest rates, demographic patterns, and economic growth. In general, Ohio’s varied economy, accessible housing alternatives, and amenities for a high standard of living put it in a good position for the real estate market to continue expanding and stabilizing.

In conclusion, Ohio’s real estate market presents a variety of possibilities for buyers, tenants, and investors, including reasonably priced homes, consistent growth, and the possibility of earning a profit on an investment.

Thank you again for allowing us to help you with your Ohio Home Loans.

Ohio Home Loans

Ohio Conventional Home Loans

Ohio FHA Home Loans

Ohio VA Home Loans

Ohio USDA Home Loans

Ohio Jumbo Home Loans

Ohio Non QM Home Loans

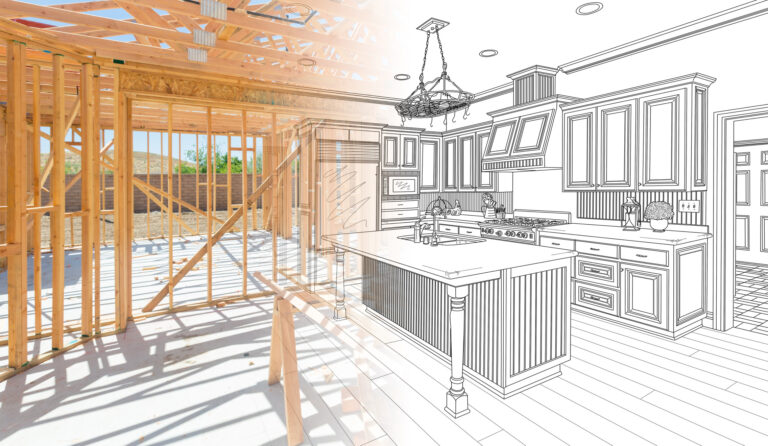

Ohio One Time Close construction Home Loans

An Ohio One-Time Close Construction Mortgage is distinct from a traditional construction home loan in combining the construction loan and the permanent mortgage into a single loan. This means you only have to go through the application and closing process once, saving time and money. A traditional construction home loan requires you to apply for a separate mortgage after the construction is completed. An OTC loan also can. be combined with other standard mortgage products resulting in much smaller down payments.

Why Ohio HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

Ohio Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Ohio Home Mortgage Programs

Ohio Home Purchase loans

Looking to Purchase an Ohio Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Ohio Renovation Home Loans

Looking to Rehab an Ohio Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Ohio FHA Home loans

Great 1st Time Ohio Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Ohio va Home Loans

100% Financing for Ohio Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Ohio Conventional Home loans

Flexibility for Ohio Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

Ohio Jumbo Home Loans

Ohio Non-Conforming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Ohio USDA Home loans

Ohio 100% Rural Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Ohio Native american Home Loans

Not Available in Ohio

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Ohio Manufactured Home loans

Great Ohio Alternative Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Ohio Reverse Mortgage Loans

Your Ohio Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Ohio Non QM Home loans

Making Ohio Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Ohio One Time Close Home Loans

Build Your Ohio Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Ohio Refinance Mortgage loans

Ohio Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Ohio Cashout Mortgage Loans

Ohio Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education