Capital Home Mortgage New Jersey

New Jersey Home Loans

New Jersey Mortgage Lender

Home Loans in New Jersey

Welcome to Capital Home Mortgage New Jersey, where we strive to provide New Jersey Home Loans to New Jersey homebuyers and homeowners at competitive rates and fees while giving great service. First and foremost, we’d like to thank you for the opportunity to earn your business. We recognize that acquiring a house is the most important decision of most people’s life, which is why Capital house Mortgage New Jersey offers dedicated points of contact throughout the mortgage process. This assures a stress-free experience, with an on-time close. After all, buying a home should be enjoyable.

Capital Home Mortgage New Jersey, as a direct New Jersey Mortgage Lender, manages the entire lending process from beginning to end. Our in-house processing and underwriting enables for quick, sensible approvals and timely closings. We have complete control over every detail from the application to funding.

Capital Home Mortgage New Jersey is a full-service New Jersey Mortgage Lender that offers a wide range of mortgage products as well as competitive New Jersey Mortgage Rates. Whether you are a first-time purchaser seeking a New Jersey FHA Home Loan, looking for a rural property and needing a New Jersey USDA Home Loan, a active or retired veteran in need of an Maine VA Home Loan, or a seasoned buyer in need of a Maine Conventional Home Loan, we are here to assist.

Call today (270) 531-5048 to talk to one of our New Jersey Loan Officers.

New Jersey, known as the “Garden State” is located in the northeastern region of the United States. New Jersey is bordered by the Atlantic Ocean to the east, Delaware to the west, and New York to the north and northeast. It is the fourth-smallest state by area but the most densely populated state in the country. The largest city in New Jersey is Newark, followed by Jersey City, Paterson, Elizabeth, and Trenton, which is the state capital.

New Jersey’s economy includes manufacturing, biotechnology, finance, telecommunications, and pharmaceuticals. It is regarded as one of the richest states in the union in terms of per capita income and is home to many Fortune 500 corporations.

Renowned universities including Princeton University, Rutgers University, and the New Jersey Institute of Technology are located in New Jersey, which has a robust educational system. With comparatively high educational attainment rates as compared to the national average, the state places a high value on education.

Major thoroughfares like the Garden State Parkway and the New Jersey Turnpike are part of the state’s vast transportation system. One of the busiest airports in the country is Newark Liberty International Airport. The state also boasts a vast rail system, which includes Amtrak and NJ Transit services.

A wide variety of cultural attractions are available in New Jersey, such as theaters, museums, and historic sites. Popular tourist attraction the Jersey Shore is well-known for its boardwalks, beaches, and theme parks. The state has made major contributions to music, literature, and the arts, and it also has a rich cultural legacy.

The governor of New Jersey is the state’s chief executive officer and oversees the operation of the gubernatorial system. The Senate and the General Assembly make up the state legislature. Progressive laws pertaining to LGBTQ+ rights and environmental preservation are well-known in New Jersey.

All things considered, New Jersey is a vibrant state that significantly influences the social and economic climate of the country with its robust economy, varied culture, and lengthy history.

New Jersey’s real estate market is diverse, with a range of housing options, from urban apartments to suburban single-family homes and sprawling estates.

A number of variables, including interest rates, population growth, and economic conditions, affect the New Jersey housing market. Similar to many other places in the US, the location of a home can have a big impact on its price in New Jersey; generally speaking, regions nearer big cities are more expensive.

A combination of contemporary apartments and condominiums and historic brownstones may be found in cities like Hoboken, Newark, and Jersey City. Because of their accessibility to public transportation and closeness to New York City, these neighborhoods are well-liked by young professionals and commuters.

The suburbs of New Jersey are well-known for their family-friendly communities, excellent educational opportunities, and reasonably priced homes when compared to nearby New York. Families seeking a blend of suburban peace and urban conveniences frequently choose towns like Princeton, Montclair, and Summit.

From charming cottages to opulent waterfront houses, the Jersey Shore region has a wide selection of beachfront real estate. Coastal communities with a thriving real estate market, such as Asbury Park, Cape May, and Long Beach Island, draw summertime visitors.

New Jersey’s inland regions are home to agricultural villages and rural scenery. For those looking for a more sedate, calm lifestyle, towns like Hunterdon County and Sussex County offer larger residences, farmhouses, and equestrian estates.

The demand for eco-friendly housing options, suburban sprawl, and urban regeneration are some of the factors that can affect the real estate market in New Jersey, as they do in many other parts of the nation. The state’s real estate market can also be impacted by variables including property taxes, zoning laws, and environmental concerns.

In general, New Jersey is a dynamic market for homebuyers, investors, and developers alike since it provides a wide variety of real estate choices, from lively urban centers to serene rural getaways.

New Jersey Home Loans

New Jersey Conventional Home Loans

New Jersey FHA Home Loans

New Jersey VA Home Loans

New Jersey USDA Home Loans

New Jersey Jumbo Home Loans

New Jersey Non QM Home Loans

New Jersey One Time Close construction Home Loans

Why New Jersey HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

New Jersey Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

New Jersey Home Mortgage Programs

New Jersey Home Purchase loans

Looking to Purchase a New Jersey Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

New Jersey Renovation Home Loans

Looking to Rehab a New Jersey Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

New Jersey FHA Home loans

Great 1st Time New Jersey Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

New Jersey va Home Loans

100% Financing for New Jersey Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

New Jersey Conventional Home loans

Flexibility for New Jersey Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

New Jersey Jumbo Home Loans

New Jersey Non-Conforming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

New Jersey USDA Home loans

New Jersey 100% Rural Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

New Jersey Native american Home Loans

Not Available in New Jersey

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

New Jersey Manufactured Home loans

Great New Jersey Alternative Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

New Jersey Reverse Mortgage Loans

Your New Jersey Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

New Jersey Non QM Home loans

Making New Jersey Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

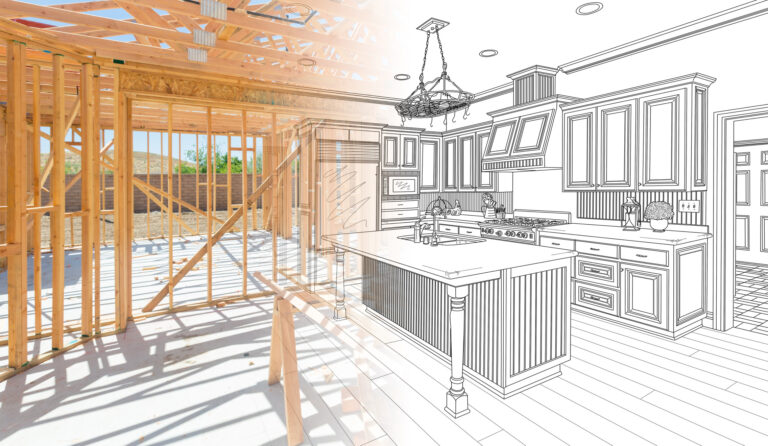

New Jersey One Time Close Home Loans

Build Your New Jersey Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

New Jersey Refinance Mortgage loans

New Jersey Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

New Jersey Cashout Mortgage Loans

New Jersey Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education