Capital Home Mortgage New Hampshire

New Hampshire Home Loans

New Hampshire Mortgage Lender

Home Loans in New Hampshire

Welcome to Capital Home Mortgage New Hampshire, where we strive to provide New Hampshire Home Loans to New Hampshire homebuyers and homeowners at competitive rates and fees while giving great service. First and foremost, we’d like to thank you for the opportunity to earn your business. We recognize that acquiring a house is the most important decision of most people’s life, which is why Capital house Mortgage New Hampshire offers dedicated points of contact throughout the mortgage process. This assures a stress-free experience, with an on-time close. After all, buying a home should be enjoyable.

Capital Home Mortgage New Hampshire, as a direct New Hampshire Mortgage Lender, manages the entire lending process from beginning to end. Our in-house processing and underwriting enables for quick, sensible approvals and timely closings. We have complete control over every detail from the application to funding.

Capital Home Mortgage New Hampshire is a full-service New Hampshire Mortgage Lender that offers a wide range of mortgage products as well as competitive New Hampshire Mortgage Rates. Whether you are a first-time purchaser seeking a New Hampshire FHA Home Loan, looking for a rural property and needing a New Hampshire USDA Home Loan, a active or retired veteran in need of a New Hampshire VA Home Loan, or a seasoned buyer in need of a New Hampshire Conventional Home Loan, we are here to assist.

Call today (603) 255-7099 to talk to one of our New Hampshire Loan Officers.

New Hampshire, known as the “Granite State” is in the northeastern part of the country and is renowned for its rugged charm, rich history, and independent spirit. Vermont to the west, Maine to the east, Massachusetts to the south, and the Canadian province of Quebec to the north are the states that border New Hampshire. It is the tenth least populated state in the union and the fifth smallest state in terms of area. The White Mountains in the north, lakes, rivers, and extensive woods define the state’s terrain, which attracts many outdoor enthusiasts.

Major industries in New Hampshire’s varied economy are manufacturing, tourism, healthcare, and technology.

The state is well-known for its low tax rates and welcoming business climate, which draw a variety of businesses, especially those in the manufacturing and high-tech sectors. The state’s economy heavily depends on tourism, which is attracted by the region’s historic sites, ski resorts, and natural features.

Because of its early primary elections, which frequently influence the presidential nomination process, New Hampshire is well-known for playing a significant role in national politics. The state is regarded as a swing state in politics because residents frequently support both Democratic and Republican candidates in separate elections.

Southern New Hampshire University, the University of New Hampshire, and Dartmouth College are just a few of the esteemed schools and universities in New Hampshire. With comparatively high rates of high school and college graduation, the state places a major emphasis on education.

With influences from early European settlers, Native American tribes, and a legacy of independence and individualism, New Hampshire boasts a diverse cultural past.

The state celebrates its history, arts, and regional customs all year long with a plethora of cultural events, festivals, and festivities.

Hiking, skiing, fishing, and camping are among the popular outdoor activities in New Hampshire, where the state’s natural beauty is cherished by both locals and tourists.

New Hampshire is a fascinating and dynamic state in the union because it combines a thriving economy, breathtaking natural vistas, a rich cultural legacy, and a distinctive political landscape.

Over time, the real estate market in New Hampshire has grown steadily. A robust economy, low unemployment rates, and a desired standard of living have all contributed to the demand for homes.

Due to a lack of supply and strong demand, New Hampshire’s home prices have increased, similar to those of many other states. In New Hampshire, the median price of a home tends to vary by geography. Greater Boston and other southern areas of the state usually have higher costs, while the northern and western sections of the state tend to have more reasonably priced homes.

A problem facing the New Hampshire real estate industry has been a lack of available homes, especially for those in the inexpensive housing market. Due to the increasing rivalry among purchasers brought about by the shortage, it is now more difficult for first-time buyers or those on a tight budget to discover suitable properties, which has raised prices.

Another element influencing demand in the New Hampshire real estate market is the historically low mortgage interest rates. Low rates encourage potential buyers to enter the market and make homeownership more accessible.

New Hampshire has a range of living alternatives, including suburban, urban, and rural. While larger places like Manchester and Nashua offer more amenities but often have higher housing costs, rural areas may have more cheap housing but fewer amenities.

Due to its picturesque scenery, which includes lakes, mountains, and forests, New Hampshire is a well-liked location for vacations and second homes. Regions such as the Lakes Region and the White Mountains draw purchasers seeking holiday homes or recreational properties.

It’s crucial to remember that real estate markets can change over time as a result of many economic and social variables.

Thank you again for allowing us to help you with your New Hampshire Home Loans. Loan.

New Hampshire Home Loans

New Hampshire Conventional Home Loans

New Hampshire FHA Home Loans

New Hampshire VA Home Loans

New Hampshire USDA Home Loans

New Hampshire Jumbo Home Loans

New Hampshire Non QM Home Loans

New Hampshire One Time Close construction Home Loans

Why New Hampshire HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

New Hampshire Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

New Hampshire Home Mortgage Programs

New Hampshire Home Purchase loans

Looking to Purchase a New Hampshire Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

New Hampshire Renovation Home Loans

Looking to Rehab a New Hampshire Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

New Hampshire FHA Home loans

Great 1st Time New Hampshire Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

New Hampshire va Home Loans

100% Financing for New Hampshire Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

New Hampshire Conventional Home loans

Flexibility for New Hampshire Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

New Hampshire Jumbo Home Loans

New Hampshire Non-Conforming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

New Hampshire USDA Home loans

New Hampshire 100% Rural Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

New Hampshire Native american Home Loans

Not Available in New Hampshire

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

New Hampshire Manufactured Home loans

Great New Hampshire Alternative Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

New Hampshire Reverse Mortgage Loans

Your New Hampshire Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

New Hampshire Non QM Home loans

Making New Hampshire Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

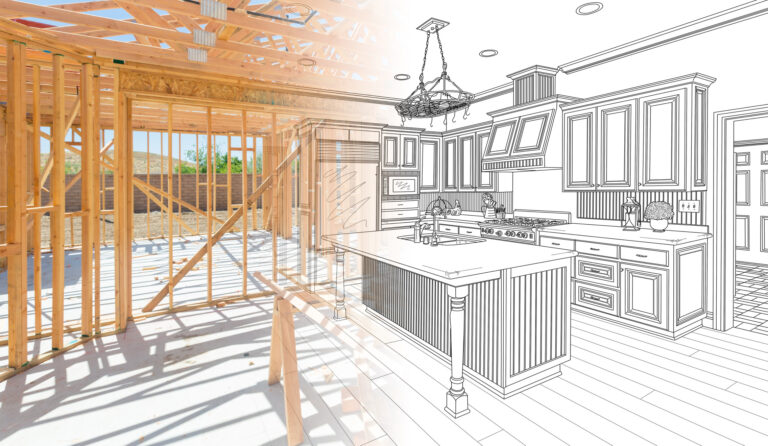

New Hampshire One Time Close Home Loans

Build Your New Hampshire Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

New Hampshire Refinance Mortgage loans

New Hampshire Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

New Hampshire Cashout Mortgage Loans

New Hampshire Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education