Capital Home Mortgage Indiana

Indiana Mortgage Lender

Home Loans in Indiana

Welcome to Capital Home Mortgage Indiana, where we strive to provide Indiana Home Loans to Indiana homebuyers and homeowners at competitive rates and fees while giving great service.

First and foremost, we’d like to thank you for the opportunity to earn your business. We understand that acquiring a house is the most important decision of most people’s life, which is why Capital house Mortgage Indiana offers dedicated points of contact throughout the mortgage process. This assures a stress-free and pleasant experience, with an on-time close. After all, buying a home should be fun rather than stressful.

Capital Home Mortgage Indiana, as a direct Indiana mortgage lender, manages the entire lending process from beginning to end. Our in-house processing and underwriting enables for quick, reasonable approvals and timely closings. We have complete control over everything from the application to the funding process.

Capital Home Mortgage Indiana is a full-service Indiana mortgage lender that offers a comprehensive range of mortgage products as well as competitive Indiana Mortgage Rates. Whether you are a first-time purchaser seeking for an Indiana FHA Home Loan, looking at rural property and needing an Indiana USDA Home Loan, a Native American wanting to use a HUD 184 Indiana Native American Home Loan, an active duty or retired veteran in need of an Indiana VA Home Loan, or a seasoned buyer in need of an Indiana Conventional Home Loan, we can Help.

Call today (812) 355-6434 to speak with our Indiana Loan Officers.

Indiana, the Hoosier State, is located in the Midwestern and Great Lakes regions of the United States. Recognized for its diverse geography, including flat plains, rolling hills, and the Hoosier National Forest. It is also home to the Wabash River, the longest free-flowing river east of the Mississippi River.

The state has a diverse economy with manufacturing, agriculture, and services playing significant roles. Indianapolis is a major hub for finance, insurance, real estate, professional services, and healthcare.

Indiana is home to several institutions of higher education, including Purdue University and Indiana University. Basketball holds a special place in Indiana’s culture, and the state is passionate about high school and college basketball. Indianapolis hosts , one of the most famous auto races in the world, Indianapolis 500.

The state has a rich cultural heritage with influences from Native American, European, and African American traditions.Indiana generally has a more affordable housing market compared to the national average. However, specific prices can vary based on the region, urban or rural areas, and local economic factors.

The real estate market in Indiana has shown stability, with moderate appreciation in home values in various areas. Market trends can be influenced by factors such as job growth, population changes, and economic development.Cities like Indianapolis may experience higher demand and faster-paced markets compared to rural areas. The availability of amenities, job opportunities, and infrastructure can impact the real estate dynamics in different regions.Indiana is often considered more affordable than many other states. This affordability can be attractive to both homebuyers and real estate investors.

The state’s overall economic health, job market, and industrial development can influence the real estate market. Indiana’s diverse economy, with strengths in manufacturing, agriculture, and services, can contribute to stability.

Thank you again for allowing us to help you with your Indiana Home Loan.

Indiana Home Loans

Indiana Conventional Home Loans

An Indiana Conventional Home Mortgage adhere to Fannie Mae and Freddie Mac requirements. These loans can be used for primary residence, secondary and investment properties. Typical eligibility requirements include a minimum credit score of 620, a stable income, and a minimum down payment. Conventional Home Loans are also called Conforming loans and have capped loan limits that are updated annually on January 1st base on the median selling price within a local area.

Indiana FHA Home Loans

An Indiana FHA Home Mortgage is a mortgage insured by the Federal Housing Administration or “FHA” and issued by an FHA-approved lender. FHA loans are designed for low-to-moderate-income applicants and first time homebuyers who need a smaller down payment. However, FHA home loans can be used by anyone.

FHA home loans feature a low down payment, flexible credit score requirements and the ability to use gift funds for the down payment. Other eligibility requirements for an Indiana FHA home loan is consistent employment history and documented income.

Indiana VA Home Loans

An Indiana VA Home Mortgage is a mortgage option for qualified veterans, active-duty service members, and select surviving spouses in Indiana. These loans are made by private lenders but are guaranteed by the United States Department of Veterans Affairs, allowing for favorable terms such as no down payment and no private mortgage insurance (PMI). VA home loans are widely available, with competitive interest rates and liberal credit standards.

Indiana USDA Home Loans

Indiana Jumbo Home Loans

Indiana Non QM Home Loans

An Indiana Non-Qualified-Mortgage-Loans, also known as a Non-QM loan, is a form of mortgage loan that does not meet the government-sponsored enterprise (GSE) requirements for a qualified mortgage. Borrowers who fail to meet the tight standards of a qualifying mortgage, such as those with irregular income or a high debt-to-income ratio, are perfect candidates for this sort of loan.

Indiana Native american Home Loans

An Indiana Native American Mortgage, also known as a HUD 184 Home Loan, is a government mortgage loan specifically for registered Indiana Native Americans. This loan offers easier credit qualifications, tribal grants and can be used to renovate the home along with the purchase.

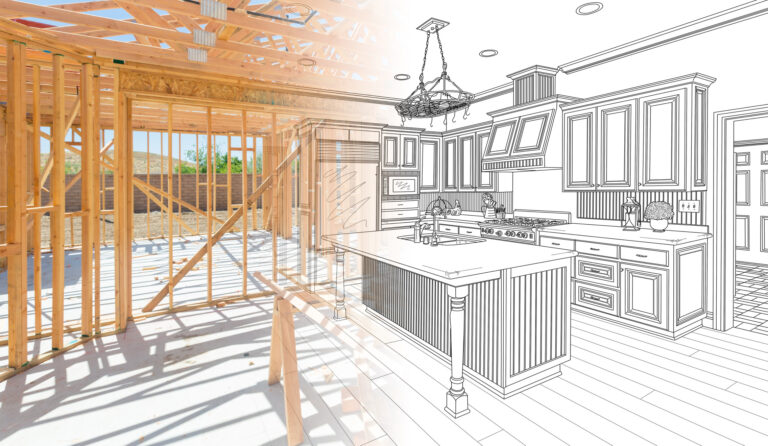

Indiana One Time Close construction Home Loans

An Indiana One-Time Close Construction Mortgage is distinct from a traditional construction home loan in combining the construction loan and the permanent mortgage into a single loan. This means you only have to go through the application and closing process once, saving time and money. A traditional construction home loan requires you to apply for a separate mortgage after the construction is completed. An OTC loan also can. be combined with other standard mortgage products resulting in much smaller down payments.

Why Indiana HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

Indiana Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Indiana Home Mortgage Programs

Indiana Home Purchase loans

Looking to Purchase an Indiana Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Indiana Renovation Home Loans

Looking to Rehab an Indiana Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Indiana FHA Home loans

Great 1st Time Indiana Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Indiana va Home Loans

100% Financing for Indiana Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Indiana Conventional Home loans

Flexibility for Indiana Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

Indiana Jumbo Home Loans

Indiana Non-Conforming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Indiana USDA Home loans

Indiana 100% Rural Home Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Indiana Native american Home Loans

Indiana Hud 184 Home Loans

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Indiana Manufactured Home loans

Great Indiana Alternative Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Indiana Reverse Mortgage Loans

Your Indiana Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Indiana Non QM Home loans

Making Indiana Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Indiana One Time Close Home Loans

Build Your Indiana Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Indiana Refinance Mortgage loans

Indiana Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Indiana Cashout Mortgage Loans

Indiana Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education