Native American Mortgage Lender Seattle Washington

Native American Home Loans In Seattle Washington

The Section 184 Indian Home Loan Guarantee Program, instituted by Congress in 1992, primarily facilitates the Native American home loan program in Seattle, Washington. This program is intended to assist American Indian and Alaska Native families, Alaska villages, tribes, and tribally designated housing entities in achieving homeownership and gaining greater access to capital.

In Seattle, the Northwest Office of Native American Programs (NWONAP) ensures that Native American families can access safe, decent, and affordable housing while nurturing economic opportunities for tribes and Indian housing residents.

The program offers options for low down payments and flexible underwriting to make homeownership more accessible for Native Americans. Section 184 loans can be used for various purposes, including new construction, rehabilitation, purchasing an existing property, and refinancing on and off native lands. The loans are backed by HUD’s Office of Native American Programs’ Office of Loan Guarantee, assuring lenders that their investment will be repaid in full in the event of foreclosure.

Section 184 Eligibility Requirements

To be eligible for a Section 184 loan, you must be a nationally recognized tribe member or a Native Hawaiian. If you qualify, you should be able to apply for a Section 184 loan in Seattle, Washington, and are buying a home that will be your primary residence.

The eligibility requirements for a Section 184 loan in Seattle include the following:

Native American / American Indian Heritage

The applicant must be a Native American/American Indian who intends to purchase a principal dwelling. An Indian tribe, the federal government, or any state should additionally acknowledge the individual or their family member(s) as Indian or Alaska Native.

Location

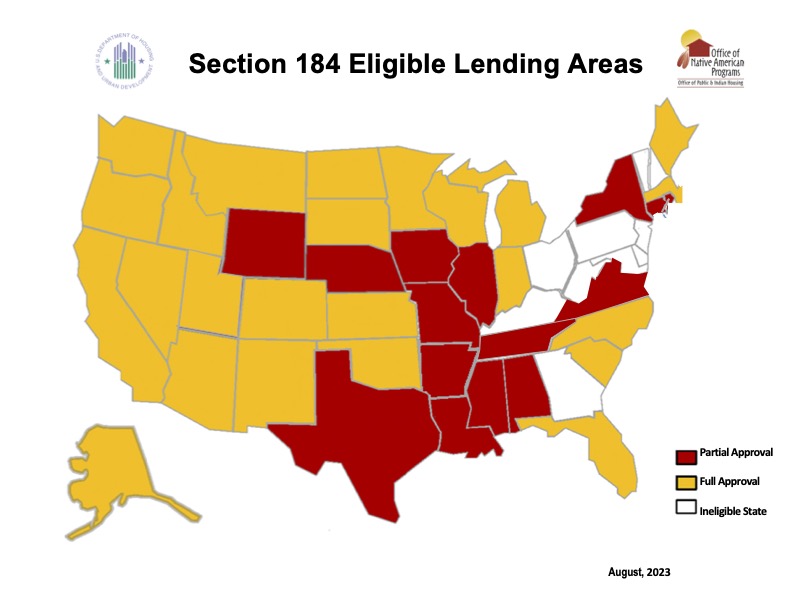

Section 184 loans may be utilized on and off native lands. Washington, including Seattle, is among the locations where these loans are permitted.

Loan Terms

The loan term must be at most 30 years, and the financing must be at most the market interest rate. The maximum loan amount is 150% of the area’s Federal Housing Administration (FHA) lending limit. There are also no prepayment penalties with this service.

Application Process

If leasing tribal land, the borrower should engage with the tribe and the Bureau of Indian Affairs to apply for a Section 184 loan. The lender next reviews the loan documents and submits them to HUD’s Office of Loan Guarantee for approval.

Advantages of HUD Section 184 Loan

The HUD Section 184 loans offer several benefits for borrowers. They include the following:

Low Down Payment

The down payment required is lower than for most major loan types. Borrowers must put down 2.25% on loans exceeding $50,000 and 1.25% on loans under $50,000.

Income

You must have sufficient income to be eligible for the Section 184 Loan. The lender will compare your pre-tax income to your future total payments, including your mortgage payment. Your debt-to-income (DTI) ratio, the sum of all payments, must be at most 43% of your gross income.

Flexible Underwriting

It features flexible underwriting guidelines, making lending more accessible to a broader range of borrowers.

Various Usage

These loans can be utilized for various purposes, including new construction, renovation, property purchase, and refinance1. They can be used both on and off indigenous lands.

Loan Guarantee

The Section 184 home mortgage loans issued to Native borrowers are guaranteed by the Office of Loan Guarantee, which is part of HUD’s Office of Native American Programs. This guarantee ensures that the lender’s investment will be fully returned in the case of foreclosure.

Fixed Rate Financing

The loans provide fixed-rate financing that cannot exceed the market interest rate.

Loan Terms

The loan term is 30 years maximum.

No Prepayment Penalties

There are no prepayment penalties, so borrowers can pay off their loans sooner without incurring any penalties.

Higher Loan Limits

The maximum loan amount is 150% of the area’s Federal Housing Administration (FHA) lending limit. For 2023, the FHA loan ceiling for a single-family home in King County, Washington, is $977,500. Borrowers in Seattle can borrow up to $1,466.250 for a single-family home.

Apply for a Seattle Section 184 Loan with Capital Home Mortgage

Capital Home Mortgage provides numerous advantages to Seattle borrowers pursuing a Section 184 loan. The Section 184 Indian Home Loan Guarantee Program is intended to increase access to capital in Native American communities and facilitate homeownership.

Capital Home Mortgage Seattle‘s participation in this program enables applicants in Seattle to take advantage of reduced down payment requirements. Borrowers in Seattle who choose Capital Home Mortgage Seattle can experience these benefits of the Section 184 loan in addition to the company’s financial expertise, customer service, and commitment to serving Native communities. The ultimate benefit is a safe, efficient, and streamlined path to homeownership for Seattle’s Native American families.

Call our Seattle Native American Team at (800) 536-8171 for your HUD Section 184 loan.

Why Seattle HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

Seattle Washington Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Seattle Native American Purchase Loans

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Seattle Native American REfinance Loans

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Seattle Washington Native American Mortgage Team

Seattle Mortgage Programs

Seattle Home Purchase loans

Looking to Purchase a Seattle Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Seattle Renovation Home Loans

Looking to Rehab a Seattle Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Seattle FHA Home loans

Great 1st Time Seattle Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Seattle va Home Loans

100% Financing for Seattle Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Seattle Conventional Home loans

Flexibility for Seattle Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

Seattle Jumbo Home Loans

Seattle Non-Confirming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Seattle USDA Home loans

100% Rural Seattle Home Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Seattle Native american Home Loans

Seattle Hud 184 Home Loans

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Seattle Manufactured Home loans

Great Alternative Seattle Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Seattle Reverse Mortgage Loans

Your Seattle Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Seattle Non QM Home loans

Making Seattle Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Seattle One Time Close Home Loans

Build Your Seattle Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Seattle Refinance Mortgage loans

Seattle Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Seattle Cashout Mortgage Loans

Seattle Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education