Native American Mortgage Lender Spokane Washington

Native American Home Loans In Spokane Washington

What is Section 184 Native American Home Loan?

The Section 184 Indian Home Loan Guarantee Program is a mortgage loan product explicitly designed for American Indian and Alaska Native families, tribes, and tribally designated housing entities. The program was established by Congress in 1992 to increase access to capital and facilitate homeownership in Native American communities. On or off native lands, Section 184 loans may be used for new construction, rehabilitation, the purchase of an existing property, or refinancing.

Key Features of HUD Section 184 Loan?

The key features of the Section 184 Home Loan program include the following:

Eligibility

The program is accessible to federally recognized American Indians or Alaska Natives, federally recognized Indian tribes, tribally designated housing entities, and Indian Housing Authorities.

Types of Homes

The Section 184 program is only available to single-family dwellings (with 1-4 units).

Loan Characteristics

The loan must be a 30-year fixed-rate loan or less. The maximum loan amount is 150% of the area’s Federal Housing Administration (FHA) lending limit. Prepayment penalties do not exist.

Usage

Section 184 loans can be used for new construction, rehabilitation, home purchase, or refinancing. These are suitable for use both on and off native lands.

Guarantee

In the event of foreclosure, the Office of Loan Guarantee assures the lender that its investment will be repaid in full.

Additional loan programs are also available, such as the Native American Direct Loan (NADL) program for Veterans. It enables Native American or non-Native American Veterans married to Native Americans to obtain a loan to purchase, construct, or modify a home on federal trust land.

What are the Advantages of Section 184 Home Loan?

The Section 184 Indian Home Loan Guarantee Program, created specifically for American Indian and Alaska Native families, tribes, and tribally designated housing entities, offers several benefits that facilitate homeownership and expand access to capital in Native American communities.

The primary advantages of Section 184 Home Loans include the following:

Low Down Payment

The program requires a 2.25 percent down payment for loans over $50,000 but only a 1.25 percent down payment for loans under $50,000. This is typically less than many other loan types, including FHA 203(b) loans requiring a minimum 3.5% down payment.

No Mortgage Insurance

Section 184 loans, unlike FHA loans, do not require monthly mortgage insurance, resulting in substantial savings over the loan term.

Lower Interest Rates

Regardless of the borrower’s credit score, the interest rates on Section 184 loans will never exceed the market rate.

Flexible Credit Score Requirements

Unlike FHA and other loan programs, section 184 loans do not have minimum credit score requirements.

Loan Term and Interest Rate

Loan terms are limited to 30 years, and interest rates do not exceed the market interest rate.

Variety of Uses

The loans may be used for new construction, rehabilitation, purchasing an existing property, or refinancing on and off native lands.

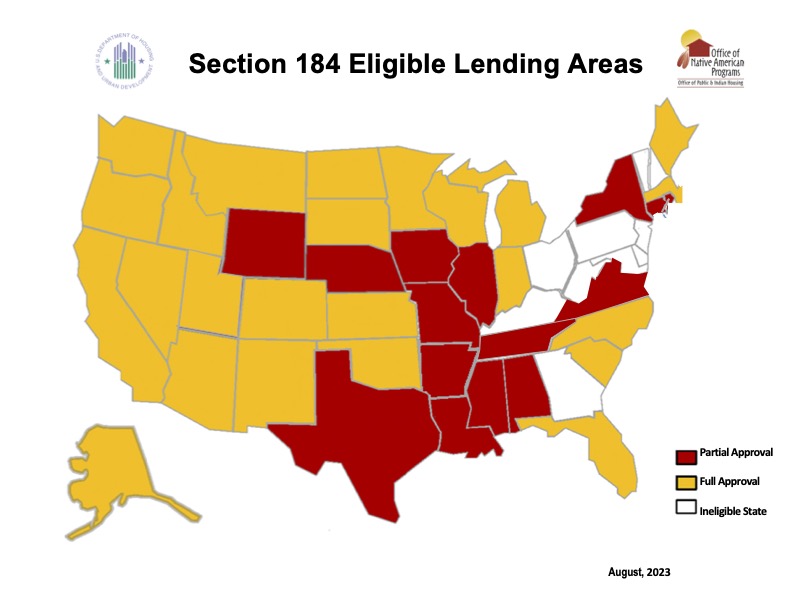

Broad Availability

Except for New York, these loans are available to all federally recognized tribe members, regardless of their state of residence.

Tribal Land Protection

The restrictions governing a Section 184 Home Loan ensure that the tribe’s land is preserved and that the tribe can repurchase the foreclosed property.

Apply for a Native American Home Loan Guarantee Program

Homebuyers in Spokane should consider Capital Home Mortgage for a Section 184 mortgage due to several significant advantages. First, Capital Home Mortgage facilitates the Section 184 Indian Home Loan Guarantee Program, designed to increase access to capital and homeownership opportunities for American Indian and Alaska Native families, tribes, and housing entities. Second, Section 184 loans offer options for low down payments and flexible underwriting, making it more straightforward for prospective homebuyers to qualify for financing. Capital Home Mortgage is a HUD-approved, participating lender for Section 184 financing, ensuring a streamlined application and approval process. Spokane homebuyers who utilize Capital Home Mortgage for a Section 184 mortgage benefit from specialized expertise, increased access to capital, and a streamlined process tailored to their specific needs and eligibility requirements.

Call our Native American Team at (800) 536-8171 for more information about HUD Section 184 loans in Spokane.

Why Spokane HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Payment

Spokane Washington Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Spokane Native American Purchase Loans

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Spokane Native American REfinance Loans

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Spokane Washington Native American Mortgage Team

Spokane Mortgage Programs

Spokane Home Purchase loans

Looking to Purchase a Spokane Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Spokane Renovation Home Loans

Looking to Rehab a Spokane Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Spokane FHA Home loans

Great 1st Time Spokane Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Spokane va Home Loans

100% Financing for Spokane Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Spokane Conventional Home Loans

Flexibility for Spokane Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Terms

- Renovation Programs Available

Spokane Jumbo Home Loans

Spokane Non-Confirming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Spokane USDA Home loans

100% Rural Spokane Home Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Spokane Native american Home Loans

Spokane Hud 184 Home Loans

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Spokane Manufactured Home loans

Great Alternative Spokane Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Spokane Reverse Mortgage Loans

Your Spokane Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Spokane Non QM Home loans

Making Spokane Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Spokane One Time Close Home Loans

Build Your Spokane Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Spokane Refinance Mortgage loans

Spokane Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Spokane Cashout Mortgage Loans

Spokane Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education