Native American Mortgage Lender Colorado

Native American Home Loans In Colorado

The Section 184 Loan Program, managed by HUD’s Office of Native American Programs, was created to give Native American and Alaskan Native tribal members access to mortgage financing. The Office of Loan Guarantee guarantees 100% of Section 184 house loans to the lender in case of foreclosure and claim.

Section 184 Background and Purpose

The Housing and Community Development Act of 1992 established the Section 184 Indian Home Loan Guarantee Program to address the shortage of mortgage lending in Indian Country. Historically, Native American homeownership has been underserved. Land under trust for a tribe cannot be mortgaged, and land in trust for an individual requires approval from the Bureau of Indian Affairs (BIA) before a lien is put on the property. Lenders have found it difficult to issue home loans to individual Native Americans because they lack the power to mortgage and foreclose on a home or establish a lien on individual trust property.

The Section 184 Indian Home Loan Guarantee Program, in collaboration with an expanding network of private sector and tribal partners, seeks to increase access to capital for Native Americans while providing private funding opportunities for tribal housing agencies.

Borrower Criteria of Section 184 Home Loan Guarantee

Section 184 Indian Home Loan Guarantee Program loans can be utilized for new construction, renovation, acquiring an existing home, or refinancing on and off native territory. To help enhance access to financing, the Office of Loan Guarantee within HUD’s Office of Native American Programs insures Section 184 residential mortgage loans provided to Native borrowers. The initiative encourages lenders to serve Native communities by providing a 100 percent guarantee. This raises the marketability and value of Native assets while also strengthening Native communities’ financial standing.

Income Limits

There are no income limits for the HUD Section 184 program.

Credit

Interest rates are determined by market rates rather than an applicant’s credit score. There is no minimum credit score needed to participate in the program. However, the borrower must be creditworthy in all instances. Alternative credit is permitted but not as a replacement for regular credit. When delinquent accounts appear on a borrower’s credit report, underwriters must use their best judgment and experience to determine whether the late payments resulted from the applicants’ disregard for financial obligations, inability to manage them, or factors beyond their control.

Occupancy

The program is for primary residences only. No second homes or investment properties are allowed.

Special Populations

Borrowers who want to use the Section 184 Indian Home Loan Guarantee Program must be a member of a Federally Recognized Tribe or an Alaska Native.

Property Type

Only single-family dwellings with one to four units are permitted. Homes must be of standard quality and adhere to all applicable building and safety requirements. Furthermore, homes must be small in size and style.

Loan Criteria

Loan Limits

The maximum loan amount cannot exceed 150 percent of the current FHA mortgage limits. FHA mortgage limits differ depending on the number of units and the county or Metropolitan Statistical Area in which the property is located. Every year, HUD publishes a Mortgagee Letter stating the new mortgage restrictions.

Loan-to-Value Limits

The LTV on loans exceeding $50,000 is 97.75 percent, and the LTV on loans under $50,000 is 98.75 percent.

Down Payment Sources

No requirement for personal money. Gifts and down payment assistance programs from organizations with a clearly defined and documented interest in the applicant are allowed.

Debt-to-Income Ratios

At most, 41 percent, or 43 percent, with two or more compensating factors (lower loan-to-value ratio, limited rise in housing costs, solid credit history, additional income not utilized as qualifying income, significant cash reserves).

Apply for a Section 184 Home Loan Guarantee Program

If you are a Native American and believe you might be eligible for a Section 184 loan, the mortgage experts at Capital Home Mortgage can help.

We provide no-cost consultations, respond to any questions about a Section 184 home loan program, and assist you at every step. Call our Native American Team at (303) 226-1177 immediately!

Colorado Native American Home Loans

The HUD 184 Native American Home Loan Guarantee Program is a home mortgage product designed to increase access to capital and facilitate homeownership for American Indian and Colorado Native families, Colorado villages, tribes, or tribally designated housing entities. Congress established this program in 1992.

The federal government guarantees the Section 184 loan, available to qualified borrowers through private financial institutions certified by the program. These lenders, which include national and local institutions, have been trained in the particular circumstances of Native American property ownership.

The program provides loans in three key categories: purchase, construction, and refinance. Borrowers may be eligible for more security, benefits, and a smaller down payment than with other lending programs. Furthermore, Fannie Mae purchases HUD-184 Guaranteed loans, which provide Native Americans with reduced down payments and other benefits.

How Do I Qualify For HUD 184 Loan Program?

To qualify for the HUD 184 Loan Program, you must be a Native American/American Indian in the process of buying a home that will be your primary residence, and you or your family members must also be recognized as being Indian or Alaska Native by an Indian tribe, the Federal Government, or any State. In addition to meeting these eligibility requirements, there are some other factors to consider:

- Enrollment: To use the Section 184 Loan, you must be a currently enrolled member of a Federally Recognized Tribe. Verification of enrollment will be required when applying for a Section 184 loan. Neither Section 184 nor approved lenders can assist in this enrollment process.

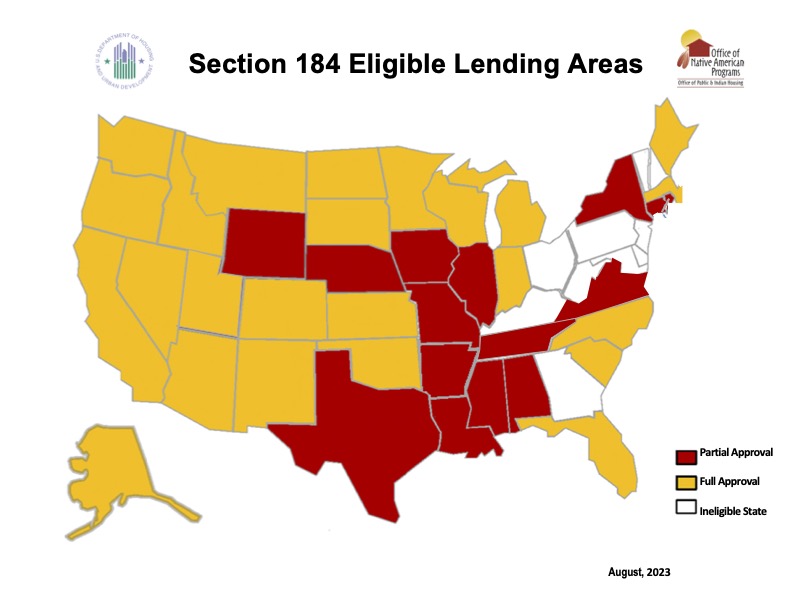

- Eligible areas: Loans must be made in an eligible area. The program has grown to include eligible areas beyond tribal trust land. Borrowers can check participating States and counties nationwide on the HUD website.

- Lender Participation: Borrowers must apply with a HUD-approved Section 184 lender.

- Credit History: A bankruptcy must have been discharged fully, and the applicant must have re-established good credit and demonstrated an ability to manage financial affairs. There must be at least two years between the bankruptcy discharge and the mortgage application.

- Loan Terms: Section 184 loans can be used for new construction, rehabilitation, purchase of an existing home, or refinance, both on and off native lands. Loan terms and interest rates vary depending on the lender and the borrower’s creditworthiness.

If you meet the eligibility requirements and other factors mentioned above, you can prequalify for the Section 184 Loan Program and contact us to apply for the loan.

Apply For Native American Home Loan in Colorado

If you are a member of a Native American tribe and believe you are eligible for a Section 184 loan, Capital Home Mortgage can assist you. Call us at (303) 226-1177 to speak with a home loan specialist about Colorado Native American home loans.

Native American Home Loans Alaska

A home loan product for federally recognized tribal individuals, tribes, and housing companies with tribal designations is the Section 184 Indian Home Loan Guarantee program. American Indians, Alaska Natives, Tribes, Indian Housing Authorities, and Regional or Village Corporations established in accordance with the Alaska Native Claims Settlement Act are examples of eligible borrowers.

The acquisition of an existing home, renovations, new construction, and refinancing, including cash-out refinancing, can all be financed with a HUD Native American Home Loan. The entire state of Alaska allows Native American Home Loans.

Eligibility Requirements for HUD Section 184 Credit

To be eligible for the program, there is no minimum credit score requirement. The borrower must, however, consistently be creditworthy. Alternative forms of credit are acceptable but cannot replace conventional forms.

According to their borrower’s credit report, borrowers must establish a track record of fulfilling financial responsibilities. All liens, collections, and judgements shall be paid in full. All accounts must have made their past-due payments on schedule.

The down payment

The down payment will be 2.25 percent of the home’s appraised value or the purchase price, whichever is less. For loans under $50,000, a 1.25 percent down payment is required.

Payroll to Income Ratio

There must be a 41% debt-to-income ratio, but it may be greater if there are other compensating variables. This means that your monthly mortgage payment and all other debts, including credit card debt and other unsecured debt, cannot exceed 41% of your gross monthly income. As a result, you will have less money available to pay your mortgage if you have a lot of debt.

Property

The property being purchased must meet lending criteria. The lot needs to be subject to site control, and the lender will send an appraiser to confirm the property’s worth and condition.

Tribal Membership

The borrower must provide documentation proving their membership in an Indian tribe or business registered under the Alaska Native Claims Settlement Act that has received federal recognition. Who is a member and how membership is verified are decisions made by the tribe/corporation. Members typically receive a membership card from the tribe/corporation. The borrower must deliver a copy of their membership card in order to demonstrate eligibility.

Apply for a Section 184 home loan in Alaska.

Capital Home Mortgage might be able to help if you are a member of a Native American tribe and you think you are eligible for a Section 184 loan. To speak with a home loan specialist about Alaska Native American home loans, call (907) 531-5048.

Why Colorado HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Mortgage Payment

Colorado Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Colorado Native American Purchase Loans

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Colorado Native American REfinance Loans

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Colorado Native American Mortgage Team

Colorado Mortgage Programs

Colorado Home Purchase

Thinking of Buying a Colorado Home?

Looking to Purchase a Home? We have the loan program for you… Call today to speak with a loan officer to discuss your personal mortgage options.

- Primary, Secondary, Investment

- FHA, VA, USDA, Native American

- Conventional, Jumbo, Non QM

- Reverse, Renovation, Manufactured

Colorado renovation home loans

Looking to Rehab a Colorado Home?

Want the Charm of an Older Neighborhood? But want a new place or a fresh look? Why not look at a renovation loan? Purchase the Perfect Home and make it your own. Call today.

- Remodel, Renovate or Repairs

- FHA 203K Streamline or full

- fannie mae homestyle reno

- freddie mac home choice reno

Colorado FHA Home Loans

Great for 1st Time Colorado Homebuyers

FHA Home Loans are great for first time home buyers, buyers with less than perfect credit, or buyers needing less out of pocket. Call today to get started.

- Smaller Down Payment

- Flexible Underwriting

- Higher Debt to Income Ratios

- Lower Credit Scores OK

Colorado VA Home Loans

100% Financing for Colorado Veterans

Proudly Serving Active Duty servicemen and women, as well as, retired and disabled veterans. Call today to speak with a VA loan officer.

- Simply Qualifying for Veterans

- No Down Payments Requirements

- Lower Credit Scores Accepted

- Manual Underwriting Allowed

Colorado Conventional Home Loans

Flexibility for Colorado Homebuyers

Conventional Home Loans are the best option for flexibility of property types and for mortgage loan terms. Call today to get speak to a Loan Officer.

- Primary, 2nd Home, Investment

- Great Rates & Low Fees

- Single Family and Multi-Family

- Renovation Loan Programs

Colorado Jumbo Home Loans

Colorado Non Conforming Loans

Jumbo Home Loans also called Non Conforming Home Loans are great options for buyers needing financing outside of agency limits. Call today to speak to a loan officer.

- Primary Residence and 2nd Homes

- Higher Loan Amounts – 3 Million

- Great Interest Rates

- Investor Specific Guidelines

Colorado USDA Home Loans

100% Rural Colorado Home Loans

USDA Loans are a great option for families wanting to live outside of the city. Call today to speak with a loan officer to discuss your personal loan options.

- Rural Properties Only

- Primary Residence Only

- Geographic Restrictions

- Income REstrictions

Colorado Native American Loans

Colorado HUD 184 Home Loans

HUD 184 Home Loans are solely for Native American and offer a variety of benefits. Call today to speak with a loan officer to find out more.

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

Colorado Manufactured Home Loans

Great Alternative Colorado Housing

Colorado reverse mortgages

Your Colorado Home at Work

Reverse Mortgage Loans offer seniors options to use their home’s equity for cash or to eliminate payments. Call today to get speak to a Reverse Loan Officer.

- primary residence only

- simple qualifying – equity based

- credit scores not applicable

- Minimum age 62

Colorado Non QM Home Loans

Making Colorado Mortgages Possible

Looking for Non Traditional Home Mortgage Loan? Contact a Loan Officer Today to discuss the alternative mortgage options currently available.

- Purchase, Rate and Term & Cash-out

- Primary, Secondary and Investment

- Full Doc & Bank Statements Programs

- Corporations OK

Colorado One Time Close mortgages

Build Your Colorado Dream Home

Want to Build? But unsure of what the future looks like? Remove the risk with a One Time Close Construction Loan. Call today to see how a OTC loan works.

- Primary Residence Only

- Close Once

- Lock Rate at Contract

- Traditional Final Mortgage

Colorado Refinance Mortgage Loans

Colorado Rate & Term Refinance

Refinancing can be a hard decision and the payback can sometimes be confusing. Call today and let our Loan Officers walk you through the process.

- Reduce Mortgage Term

- Lower Monthly Payments

- Appraisal Waivers

- Streamline Options Available

Colorado Cash-out Home mortgages

Colorado Equity Mortgage Loans

Cash-Out Mortgage Loans make use of the equity in your home by allowing you to refinance the current mortgage and access this equity to use as you see fit.

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Vacation or Education