Native American Mortgage Lender Arkansas

Native American Home Loans in Arkansas

Arkansas Native American Home loans are part of Section 184 Indian Home Loan Guarantee Program. This home loan product is for federally recognized tribal members, tribes, and tribally designated housing entities. Eligible borrowers include American Indians, Alaska Natives, Tribes, Indian Housing Authorities, and Regional or Village Corporations formed under the Alaska Native Claims Settlement Act. The HUD Native American Home Loan can be used to fund new construction, renovation, the purchase of an existing home, and refinancing, including cash-out refinancing. This program aims to make home ownership more accessible for Arkansas Native Americans by providing competitive interest rates, low down payment requirements, and flexible underwriting criteria for eligible borrowers.

Qualification Requirements for Arkansas Native American Home Loans

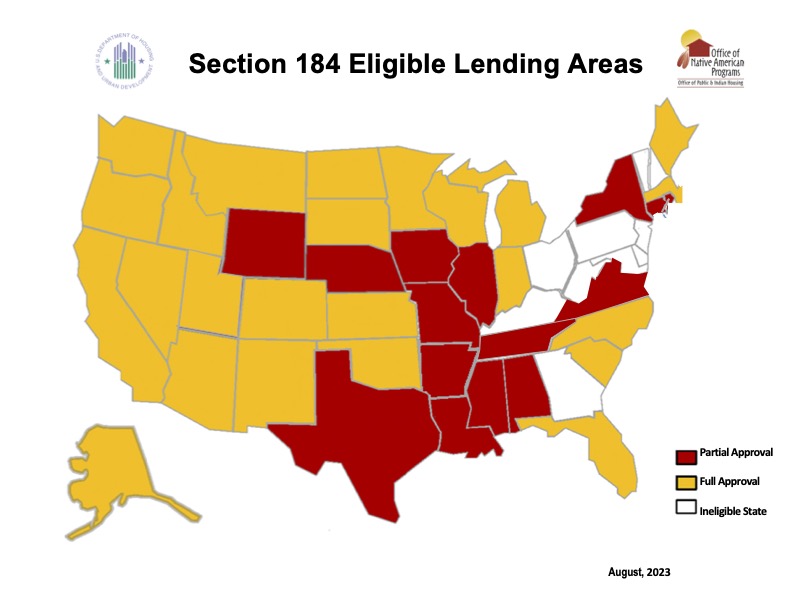

You must be an Alaskan or Native American tribal member to Qualify for a Section 184 Loan. The tribal authority decides who is accepted into the tribe and frequently provides a card or letter to prove it. It will be necessary to provide documentation of tribal membership when applying for a Section 184 loan. It is up to the participating Tribes to decide whether Section 184 eligibility applies to specific counties or the entire state.

The HUD-184 mortgage loan program requires no minimum credit score. It is the ideal solution for qualified individuals with marginal credit. Unlike most mortgage programs, marginal credit borrowers are not subject to higher interest rates.

Arkansas HUD Section 184 Eligibility Requirements

Credit

No minimum credit score is necessary to qualify for the program. However, the borrower must always be creditworthy. Alternative credit is permitted but not in place of traditional credit. Borrowers must demonstrate a track record of meeting financial obligations per their borrower’s credit report. The payment of all liens, collections, and judgments is required. All accounts must have on-time payments for the past year.

Down Payment

A 2.25 percent down payment will be required based on the lesser of the home’s appraised worth or its purchase price, Loans under $50,000 demand a 1.25 percent down payment.

Income and DTI Ratio

A debt-to-income ratio of 41% is required, which can be higher if there are other compensating factors to make up for it. This means that your mortgage payment and other debts (such as personal loans, auto loans, student loans, credit cards, etc.) can’t take up more than 41% of your gross monthly income. So, if you have a lot of debt, you will have less money left to pay your mortgage.

Property

The property being acquired must comply with lending requirements. The lender will send an appraiser to verify the condition and value of the property to be purchased; the lot must also be subject to site control.

Tribal Affiliation

The borrower must present proof of membership in a federally recognized Indian tribe. The tribe/corporation determines who is a member and how membership is documented. The tribe/corporation usually gives members a membership card. To verify eligibility, the borrower must provide a copy of their membership card.

How HUD Section 184 Home Loan Programs Works

The Office of Loan Guarantee, a section of HUD’s Office of Native American Programs, insures the Section 184 Home Mortgage Loans given to Native borrowers. The loan program guarantees the lender that its investment will be repaid entirely in the event of a foreclosure.

Each county sets its borrowing restrictions for HUD Section 184 loan and HUD sets the “Max Loan Limits”. Members of federally recognized tribes that are American Indians or Alaska Natives are eligible for the loan. This year’s complete list of Indian tribes with federal recognition is available “Approved Tribes”.

The Borrower shall consult with the Tribe and the Bureau of Indian Affairs regarding its request for a Section 184 loan from a participating lender and its lease of tribal territory. After carefully reviewing the necessary loan documents, the lender submits the loan for approval to HUD’s Office of Loan Guarantee.

apply for an Arkansas HUD Section 184 Home Loan

Why Arkansas HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Mortgage Payment

Arkansas Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Arkansas Native American Purchase Loans

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Arkansas Native American REfinance Loans

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Arkansas Mortgage Team

Arkansas Mortgage Programs

Arkansas Home Purchase loans

Looking to Purchase an Arkansas Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Arkansas Renovation Home Loans

Looking to Rehab an Arkansas Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Arkansas FHA Home loans

Great 1st Time Arkansas Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Arkansas va Home Loans

100% Financing for Arkansas Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Arkansas Conventional Home loans

Flexibility for Arkansas Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Mortgage Terms

- Renovation Programs Available

Arkansas Jumbo Home Loans

Arkansas Non-Confirming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Arkansas USDA Home loans

100% Rural Arkansas Home Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Arkansas Native american Home Loans

Arkansas Hud 184 Home Loans

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Arkansas Manufactured Home loans

Great Alternative Arkansas Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Arkansas Reverse Mortgage Loans

Your Arkansas Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Arkansas Non QM Home loans

Making Arkansas Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment Properties

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Arkansas One Time Close Home Loans

Build Your Arkansas Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Arkansas Refinance Mortgage loans

Arkansas Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Arkansas Cashout Mortgage Loans

Arkansas Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education