Capital Home Mortgage Oklahoma

Oklahoma Native American Home Loans

Oklahoma NATIVE AMERICAN Home lender

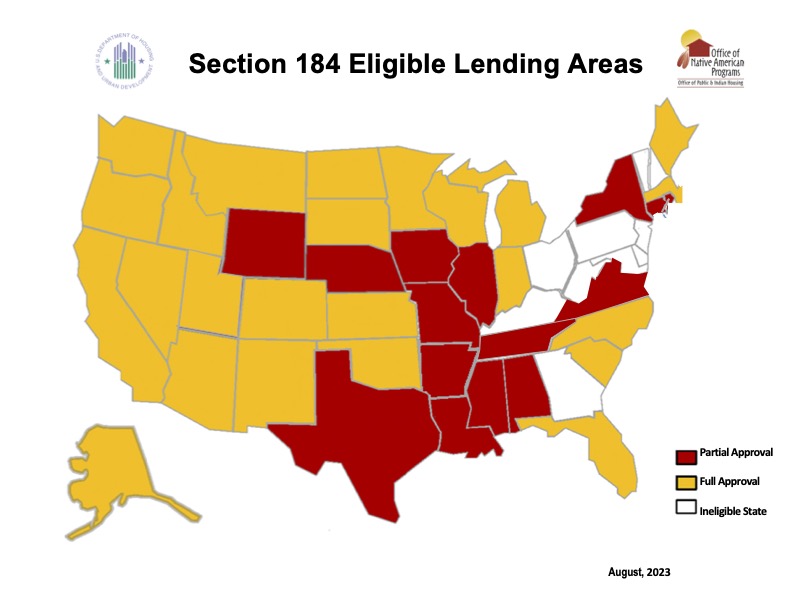

Are you a Oklahoma Native American? Capital Home Mortgage Oklahoma is an Oklahoma Native American Home Lender dedicated to helping Oklahomans with Oklahoma Native American Home Loans. The Oklahoma HUD-184 Loan is a federally-backed loan program by the Department of Housing and Urban Development. It was created specifically to provide Native American tribal members access to mortgage financing with flexible terms. The Oklahoma Section 184 Loan Program is open to any one member of a federally recognized tribe. The Loan is available to all Native Americans, first-time and repeat homebuyers, as long as they have a Tribal Membership or Citizen Card from a tribe officially recognized by the government. If you are a member of a Oklahoma Native Tribe and believe you may be eligible for a Section 184 loan, our dedicated HUD 184 Loan officers can help! We provide free consultations, answer any questions you may have about an Oklahoma Section 184 mortgage, and will walk you through all available loan options.

Capital Home Mortgage Oklahoma is a full-service Oklahoma Native American Mortgage Lender that offers and specializes in Oklahoma Native American Home Loans with low Oklahoma Native American Mortgage Rates. We have helped countless Oklahoma Native Americans achieve their homeownership, and we can do the same for you too! Call today (405) 310-8850 to speak with one of our Oklahoma HUD-184 Home Loan Specialist.

Qualifying for an Oklahoma HUD 184 Loan

Are You Interested in a HUD-184 Loan? Here are some important details you need to know before applying for the Native American Home Loans.

- Credit Score: The HUD-184 Loan does not require a minimum credit score, making it ideal for qualified but credit-challenged borrowers.

- Debt-to-Income Ratio: A single back ratio of 41% debt-to-income ratio to determine the loan size borrowers can afford.

- Borrower Income Limit: The HUD-184 Loan does not apply to borrower income limits.

- Down Payment : The HUD-184 Loan has some of the lowest down payment requirements in the market.

- Closing Costs: This money could come from your savings, investments, or gifts from family members. Tribal assistance is also accepted.

- First-Time and Repeat Buyers: Compared to other low-down-payment mortgage programs, this one is open to first-time and repeat home buyers.

- Eligible borrowers may participate in the program multiple times but are allowed only one Section 184 Loan at a time

Oklahoma Native American Purchase Loan

HUD 184 Home Loans are solely for Native Americans and offer a variety of purchase benefits.

- Primary Residences Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase an Existing Home

- Construction of a New Home

- Rehab an Existing Home

- Purchase / Rehab Combo Loan

Oklahoma Native American REfinance Loan

HUD 184 Refinance Home Loans can streamline rate & term, equity cash-out, or Rehabilitation of current residence.

CAsh-Out or Renovation

- Appraisal Required

- 97.75% Max LTV for Rehab

- 85% Max LTV for Cash-out

- County Loan Limits Apply

Streamline REfinance

- HUD 184 to HUD 184

- No Income Qualification

- No Appraisal Required

- No Mortgage Lates in Last Year

Oklahoma Native Americans Overview

Oklahoma has a rich and diverse Native American heritage, with numerous tribes having historical ties to the region. Oklahoma has been home to Native American tribes for thousands of years. Before European colonization, the region was inhabited by various indigenous peoples, including the Cherokee, Choctaw, Chickasaw, Creek (Muscogee), and Seminole, among others. These tribes had established complex societies, cultures, and governmental structures.

During the 19th century, the U.S. government forcibly relocated many Native American tribes from their ancestral lands in the southeastern United States to present-day Oklahoma. This relocation, known as the Trail of Tears, resulted in the displacement and hardship of thousands of Native Americans, particularly the Cherokee, Creek, Choctaw, Chickasaw, and Seminole nations.

Today, Oklahoma is home to 39 federally recognized tribes, more than any other state. These include large nations like the Cherokee Nation, Choctaw Nation, and Chickasaw Nation, as well as smaller tribes such as the Osage Nation, Muscogee (Creek) Nation, and Comanche Nation, among others. Each tribe has its own distinct culture, traditions, and government.

Many Native American tribes in Oklahoma exercise a degree of sovereignty and self-governance. They have their own tribal governments, judicial systems, law enforcement agencies, and cultural institutions. Tribal governments often work in partnership with federal, state, and local authorities on various issues, including law enforcement, education, healthcare, and economic development.

Native American culture and heritage are deeply ingrained in Oklahoma’s identity. Powwows, cultural festivals, and ceremonial gatherings are held throughout the state, celebrating indigenous traditions such as dance, music, art, and storytelling. Oklahoma’s rich cultural heritage is also reflected in its museums, historic sites, and monuments dedicated to Native American history.

Native American tribes in Oklahoma play a significant role in the state’s economy. Tribes are major employers, contributing to job creation and economic development through tribal businesses, casinos, agriculture, energy production, and other ventures. Revenue generated by tribal enterprises often supports tribal government operations, social services, education, and infrastructure projects.

While Native American tribes in Oklahoma have made significant strides in preserving their cultures and improving socio-economic conditions, they also face various challenges, including poverty, healthcare disparities, educational attainment gaps, and issues related to land rights and sovereignty. Efforts to address these challenges often involve collaboration between tribal, state, and federal stakeholders.

Overall, Native American tribes in Oklahoma continue to uphold their cultural heritage, sovereignty, and resilience, contributing to the state’s diverse tapestry of cultures and traditions.

Why Oklahoma HomeBuyers are Choosing Capital Home Mortgage

Close On Time

Complete Control from Application to Funding

Low Rates & Low Fees

Direct Lender with Competitive Rates & Low Fees

Exceptional Service

7 Day a Week Support Application to Final Mortgage Payment

Oklahoma Native American Mortgage Rates

Have you ever wondered why interests rates are what they are and what determines the final rate? Why borrowers receive different interest rates? Or why rates go up and down? Interest Rates are calculated using several factors.

- Demand for mortgage Securities

- Property securing the mortgage

- occupancy of the property

- Loan to value of the property

- Borrower’s credit worthiness

Oklahoma Mortgage Team

Oklahoma Mortgage Company Reviews

Oklahoma Home Mortgage Programs

Oklahoma Home Purchase loans

Looking to Purchase an Oklahoma Home?

- Primary, 2nd Home, Investment

- Low Rates & Fees, No fee Options

- FHA, VA, USDA, Native American

- Conventional, Jumbo & Renovation

- Manufactured, Construction, Reverse

Oklahoma Renovation Home Loans

Looking to Rehab an Oklahoma Home?

- Remodel, Renovate or Repairs

- FHA 203K Streamline

- FHA Full Documentation Rehab

- Fannie Mae Homestyle Reno

- Freddie Mac Home Choice Reno

Oklahoma FHA Home loans

Great 1st Time Oklahoma Homebuyers

- Smaller Down Payments

- Flexible Underwriting Guidelines

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Down Payment Gifts Allowed

Oklahoma va Home Loans

100% Financing for Oklahoma Vets

- No Mortgage Loan Limits

- Simple Qualifying

- Higher Debt to Income Allowed

- Lower Credit Scores – Down to 500

- Manual Underwriting Allowed

Oklahoma Conventional Home loans

Flexibility for Oklahoma Homebuyers

- Primary, 2nd Home, Investment Properties

- Single and Multi-Family Properties

- Variable Mortgage Insurance Options

- Low Rates & a Variety of Mortgage Terms

- Renovation Programs Available

Oklahoma Jumbo Home Loans

Oklahoma Non-Conforming Home Loans

- Primary & 2nd Homes

- Variety of Mortgage Programs

- Simple Qualifying for Veterans

- Investor Specific Guidelines

- Credit Score Minimums

Oklahoma USDA Home loans

Oklahoma 100% Rural Loans

- Primary Residences

- No Down Payment Required

- New Manufactured Homes Allowed

- Closing Costs / Repairs Rolled In

- Geographic and Income Limits Apply

Oklahoma Native american Home Loans

Oklahoma Hud 184 Home Loans

- Primary Residence Only

- Manual Underwriting for All Loans

- No Credit Score Requirements

- Tribal Grants Allowed

- Purchase, Refinance, and Renovation

Oklahoma Manufactured Home loans

Great Oklahoma Alternative Housing

- Existing Purchase or Refinance

- New Construction

- One Time Close Land/Home Combo

- Lock at Contract

- FHA, VA, USDA, Native American

Oklahoma Reverse Mortgage Loans

Your Oklahoma Home at Work

- Primary Residence Only

- Simple Qualifying – Equity Based

- No Credit Score Requirements

- Minimum Age 62

- Purchase, Refinance, and Cash-Out

Oklahoma Non QM Home loans

Making Oklahoma Mortgages Possible

- Purchase, Refinance & Cash-out

- Primary, Secondary, Investment Properties

- Full Doc Programs

- Alt Doc Programs

- Corporations OK

Oklahoma One Time Close Home Loans

Build Your Oklahoma Dream Home

- Primary Residences Only

- One Time Close

- Lock Rate at Closing

- Traditional Final Mortgages

- No Payments During Construction

Oklahoma Refinance Mortgage loans

Oklahoma Rate & Term Refinance

- Lower Monthly Payment

- Shorten Mortgage Term

- Streamline Options Available

- Appraisal Waivers Allowed

- VA IRRRL’s

Oklahoma Cashout Mortgage Loans

Oklahoma Equity Mortgage Loans

- Debt Consolidation

- Investment Opportunities

- Home Improvement

- Dream Vacation

- Higher Education